Retirement Planning

How Supplemental Retirement Planning Works

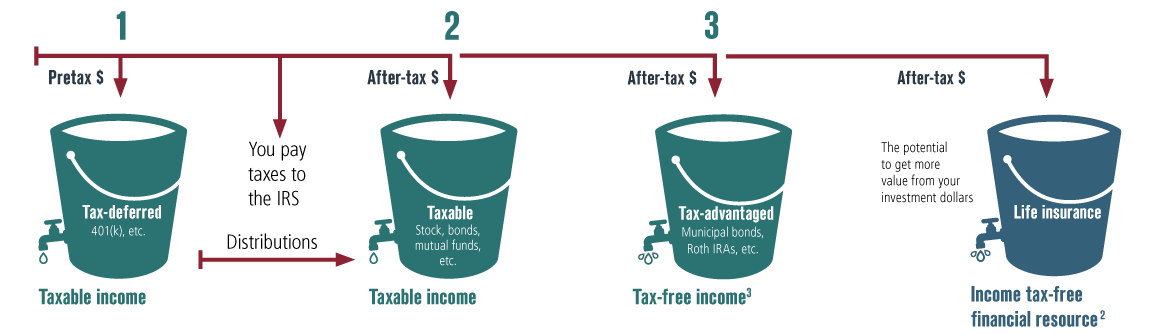

It is a life insurance policy structured to generate a tax-deferred cash flow during retirement without the downsides of other plans. This technique may be extremely useful for those wishing to explore additional options to supplement traditional retirement income sources. Note, however, that all life insurance decisions should be made with a view toward death benefit protection needs.

Plan Advantages

• The policy can provide retirement income

without excessive administrative costs or

government reporting.

• Annual contribution, vesting, and participation limits do not apply.

• Cash value is available for an individual’s needs without being subject to penalties for early withdrawals.

• Insurance policy death benefit can be removed from the taxable estate.